|

How to sell to the Oil & Gas industry:

Dear Fellow Innovator,

|

|

I have been recently invited to help a Company willing to enter the Oil & Gas industry.

The discussion with this Medium Size organization, with a long heritage in marine technology development, outstanding engineering capabilities and strong international reputation and brand has touched some points I think are worth summarize.

Oil & Gas sector attractiveness:

Someone may think that the Oil & Gas industry appeal is for the “money”. This is undeniably a sure factor. But from a technology driven supplier, what it makes really watering your mouth is the tremendous high level of complexity this industry problems lay out in front the engineers.

On this respect, the offshore side of the industry is probably the one with the most interesting challenges.

Here the players have going through a recent stream of consolidation, by M&A, aimed at gaining the size to bear the financial risks projects of ever larger size put on the table.

Project size is growing mainly because Oil & Gas Companies are looking to exploit economies of scale, this in turn points towards larger reservoirs, that today are to be found only in deep offshore basins.

This situation means that equipment and service suppliers to the offshore industry are confronted with very few, extremely large, international Clients. Companies capable to pull a widespread network of suppliers and integrate their capabilities into a single effort.

Their bargaining power is definitively low, unless they can offer an outstanding performance, capable to displace alternative solutions in terms of reliability, convenience and price.

Offering to the Oil & Gas sector:

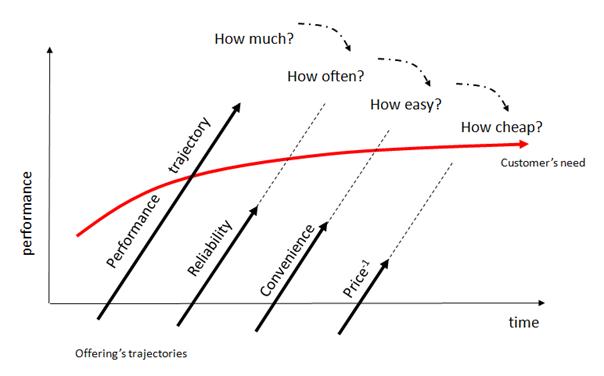

A SME can offer value to this sector, along 4 performance trajectories: Technology, Reliability, Convenience, Price. But will have to keep in mind some considerations:

If the Supplier is willing to offer its technological capability to find a solution to Customer problems, first it has to be inside customer mind and fully understand the job the Customer has to be done. For a new entrant this is not an easy task. He lacks of the experience, culture, trust, and proximity, necessary to let the information flow from customer to supplier.

In the case of Oil & Gas then, the End Users have very consolidated relationships with a crew of suppliers already jumping on the problem. And only exceptional occasions force the Client to look for new contributors. However, capacity constrains, Strict budgets, special problems, may push the client try new sources.

One of the solutions to overcome this obstacle, may be a M&A operation, or the hiring of specialized personnel, capable to bring into the Company the portfolio of know-how and relationship necessary to un-lock the opportunity.

Shaping the offer:

If in some way a Supplier have been able to understand and design a solution for the job-to-be-done a Client has been willing to share, the next obstacle lays in assuring the reliability an installation offshore deep sea definitively requires. The reputation of the supplier in other fields is not worth too much, and the offer must undergo a strict routine of certification, qualification, and pilot tests that can last years. Nobody wants to be the first to use a new product and service, especially if it is not backed up by the resources of a large organization.

This is the reason why the consolidation trends has propagated along the Oil & Gas value chain, where systems suppliers are behemoth giants spanning continents and technologies.

Bringing value to the table:

Assumed we have been able to be qualified as a tier 2 supplier of a system integrator serving the Oil &Gas end users, We have been left with just two cards to play: Convenience and Price.

And because we are Engineers, and are looking to deploy our skills to solve customer challenges, we are probably going to dismiss the “Convenience” one. Making it simple, accessible and no-frills is not something that complicated people like engineers do easily.

This brings us to our last chance: Price. This playfield is the one where we are the best suited. On one side in fact, Pricing is not the sharpest tool of an engineer. We are naturally driven to make a cost plus calculation of our efforts, in order to ask our rewards.

But there is also a more shining side of the coin. We are also naturally inclined to see things in a different way our competitors and customers do. Being not a part of the Oil & Gas family, the chances we can bring a fresh perspective to the problem our Customer is willing to solve, are in our favor.

Finding an out-of-the box solution, that re-invent the paradigms used till now to answer the challenge, is something where a fresh-man can make the difference.

Positioning our offer:

Willing to play the Oil & Gas industry Game therefore is difficult but not impossible. SME need to understand that it requires strong upfront investments in commercial operations, marketing, business development, to become part of the “Oil & Gas Family”. But that can also offer huge rewards, in case they have been able to communicate to the Tier 1 system integrator that a new-comer may be an healthy carrier of innovation and cost reduction.

Selling to the Oil & Gas industry:

Finally: "Sell". If you are a newcomer, the temptation is to take one step at time and find your way into the industy. Correct. Take one step at time, modify according the customer response. But do have a plan. Entering a new market requires:

1) a clear decision.

2) a clear (initial) plan

3) a (sirious) initial Budget

If your company wants to enter the market can not be on a "tentative" base. Must have sound up-front planning, (deep pocket) budget, and dedicated resources.

About resources: my experience is that, being Oil & Gas industry a USA DNA industry, when you select your front-runner, you may want to look at a British or American professional. These people has the standing, the commercial acumen and the vocabulary of the industry at their fingertips. They are more easely accepted, introduced in the lobby.

Timing:

A last consideration a would give to the "timing". The Oil & Gas industry is a tight one. strong entry barriers made of certifications, supplier approvals, political precedences, undermine any new-comer effort.

Unless: the Customer/Segment/Application/Market has run out of supplier capacity for that specific offer you are tackling.

So think twice before to try enter the Oil & Gas Market when (target) demand is low. But be ready to exploit the need of extracapacity that can arouse. Even only just to conquer a reference.

It may be your market Pass.

Any comment?

Please let me know.

Leave a message here:

Or join the discussion here:

Flavio Tosi

Contact us, no obligations.

|

|

VDR free tool |

|

Little nightly thoughts by Business Exploration® |

|

Business Exploration

London: +44 7491 164 097 Milan: +39 02 8719 8498 Florence +39 349 648 2225

Info@business-exploration.com

P.Iva: IT 05998900483 © 2016 - all rights reserved

|

|

Addresses:

16 Perham Road - W14 9ST - London - UK c/o IF-Milano - Coworking space - via Torre, 29 - 20143 - Milano via 8 marzo, 22 - 50051 - Castelfiorentino - Tuscany - Italy

Check out our 8-days Marketing Coaching Program

|